In the first part of our publication “Cryptocurrency and mobile applications in 2022”, we looked at the main factors that led to the growth of user interest in cryptocurrency applications. With all the hype around cryptocurrencies and blockchain, it’s easy to forget that there’s some hard stuff behind it. Blockchain, Cryptocurrency, Web3: What do these terms mean and how do these technologies affect mobile apps and developers?

Read More: Decentralized trading platform

In this post, we will explain key concepts, help you understand why mobile technology is driving the popularization of the crypto ecosystem, analyze the challenges and benefits of cryptocurrency exchange apps, and explain why mobile metering companies like Adjust are playing a critical role in helping crypto – and fintech applications to become the main platform for managing their digital assets.

PART 1

What is blockchain?

Let’s leave aside buzzwords, hype and financial speculation. What really sets cryptocurrencies and Web3 apart from other technologies is the new type of server data structure. Perhaps the most appropriate word that means the technical reliability of cryptocurrencies is “blockchain”. A blockchain is a type of decentralized, distributed (and usually public) digital ledger. One could even say that it is an open and distributed database. Blockchain uses a series of records (“block” – block) that are interconnected (“chain” – chain) using cryptography. The blockchain architecture became widely known after the release of the white paper “Bitcoin” in 2008. Blockchain is also sometimes referred to as distributed ledger technology (DLT) to include other data models in this definition. These terms define what

The blockchain is maintained by a network of participants who reach an agreement on the state of the network through a consensus mechanism. This mechanism determines how networks will defend against attacks and how participants will reach a network-specific trust agreement. The most popular mechanisms are Proof of Work (PoW), which uses the Bitcoin and Ethereum networks, and Proof of Stake (PoS), which is commonly used by smart contract platforms. Tokens in these networks are distributed among participants according to the role they play in securing the network using a consensus mechanism.

Some blockchains also use smart contract technology, such as Ethereum. What makes them different from the Bitcoin network (the network that is used for the peer-to-peer transaction of bitcoin, the asset) is that such blockchains are used for more than just recording currency transactions. They can also store more complex information and execute smart contracts to conduct complex transactions based on agreed terms. Such platforms are sometimes referred to as “tier 1 networks” and, in addition to Ethereum, they include projects such as Cardano, Solana, Avalanche, Luna, Tezos, and many others. Applications built on top of these networks are called decentralized applications (dApps).

The great interest in cryptocurrency markets stems from two key approaches to using these networks: decentralized finance (DeFi) and non-fungible tokens (NFTs). DeFi is a set of applications that provide decentralized financial services to users using blockchain-based cryptocurrencies such as loans, lending, derivatives, and more. We will tell you more about NFT in the next article.

PART 2

What are cryptocurrencies and digital assets?

In the broadest sense, cryptocurrencies and NFTs are tradable digital assets built on digital ledgers (such as blockchain) and secured by cryptography. However, beyond this simple definition, cryptocurrencies can vary greatly, and how they relate to existing assets such as currencies, securities, and commodities is still a matter of debate. Some cryptocurrencies (for example, Bitcoin and Ether) are native assets, without which the functioning of a decentralized network is impossible, while others are created on top of existing platforms using smart contracts (most often Ethereum).

In addition to investing in bitcoin as a speculative asset and using smart contract platforms for decentralized applications, two other classes of cryptocurrencies are also popular among users: stablecoins and memcoins. Stablecoins are cryptocurrencies pegged to a real financial asset, most often the US dollar. They can either be centrally issued and backed by assets in a bank account (like Tether or USD Coin) or algorithmic and decentralized (like DAI). Dollar coin issuer Circle was recently valued at $9 billion , and USDC can now be used to settle with Visa and Mastercard payment networks .

Meme coins such as Doge and Shiba Inu have gained popularity and high capitalization in the market. Despite the fact that such cryptocurrencies based on Internet memes do not differ in technical novelty and functionality, they gained wide popularity and attracted media attention, due to which information about them quickly spread among users.

Interest in using DeFi applications and acquiring NFTs, as well as investing in cryptocurrencies as speculative assets or using them for payment and as a way of saving (especially in emerging markets), caused a large increase in the popularity of cryptocurrencies in 2020-2021, with the Chainalysis index The Global Crypto Adoption Index shows an annual growth of over 881% as of Q3 2021 and over 2300% since Q3 2019. Mobile apps are the primary and rapidly growing way to access these digital assets.

PART 3

Mobile Apps Play a Critical Role in the Cryptocurrency Economy

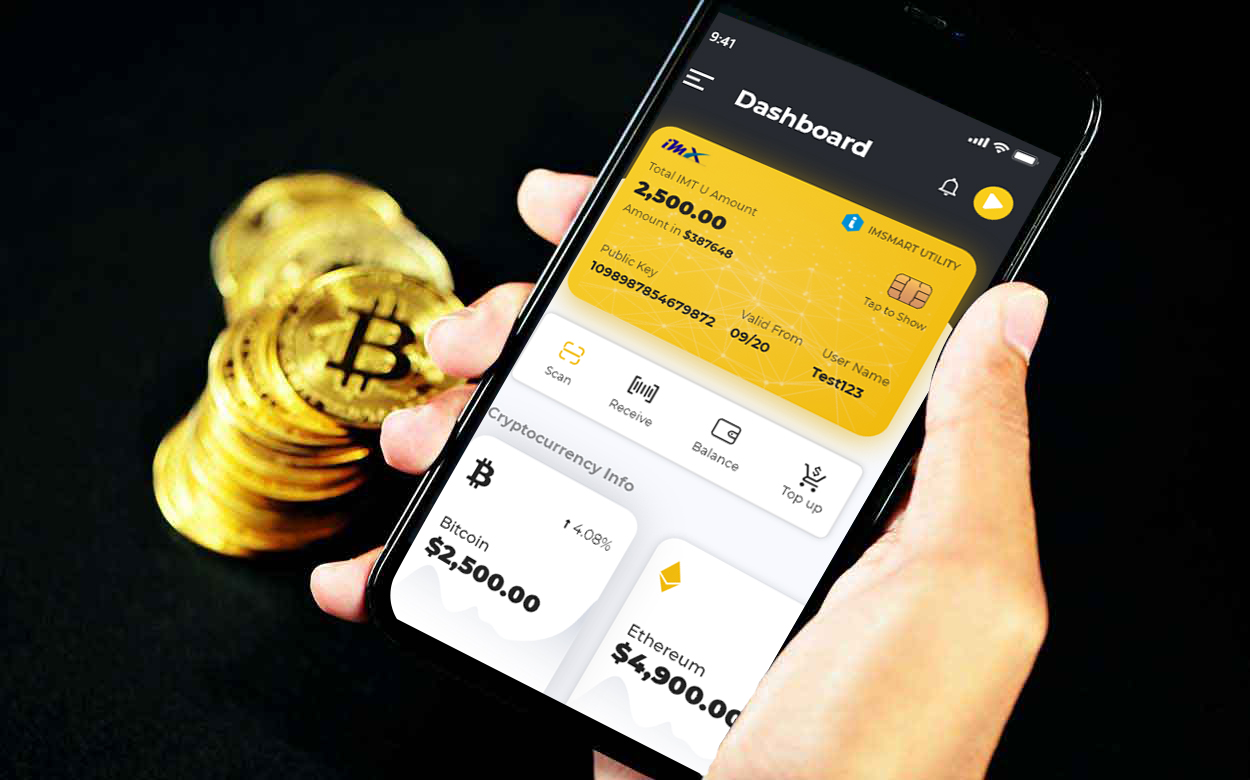

Mobile apps are becoming the main way to access cryptocurrencies and the cryptocurrency economy. Most cryptocurrency applications are used by users as exchangers to buy, sell, transfer and store cryptocurrencies. Many of these apps (such as Coinbase, CoinDCX, Binance, FTX, and crypto.com) originally dealt exclusively with cryptocurrencies, but were soon overtaken by traditional fintech apps that added functionality to buy cryptocurrencies (such as Robinhood, Square, and PayPal). Other applications related to cryptocurrencies include portfolio trackers, blockchain-based games (which we will cover in future articles in the series), and mobile wallets that store private keys to access digital assets that allow users to interact with blockchain-based dApps.

Applications such as BlockFi and Celsius Network allow not only the exchange of cryptocurrencies, but also provide financial services such as loans and credits secured by crypto-currency assets. As value rises and competition for users rises, the line between crypto exchanges, financial service providers and traditional fintech exchanges is becoming increasingly blurred as large applications seek to expand their reach in all areas.

However, as user interest in cryptocurrencies grows, so does concern from regulators. Financial regulators around the world are scrambling to figure out how to classify and control access to cryptocurrencies, and actions by regulators in the US have forced US cryptocurrency apps such as Coinbase and BlockFi to abandon some products, such as interest-bearing assets, that were not properly registered as securities. On a global scale, the ever-changing regulatory landscape is a critical determinant of how cryptocurrency applications and offerings operate.

PART 4

Challenges and Benefits of Cryptocurrency Exchange Apps

In addition to regulatory uncertainty around some financial products, cryptocurrency apps may also face challenges in mobile advertising. After the boom of cryptocurrencies in the market in 2017-2018, the largest advertising platforms such as Google, Facebook, Twitter and LinkedIn took action and banned all ads related to cryptocurrencies due to the large number of scammers in this area. However, with the development of the industry, these restrictions have been loosened, and cryptocurrency ads can once again be placed if they comply with the policy of the network.

Despite a number of problems, cryptocurrency applications also provide huge opportunities, as public interest in digital assets has increased significantly in 2021 and users have become more invested in them. As competition intensifies to become the preferred way to manage digital assets, crypto and fintech applications will need to maximize their user acquisition efforts, optimize their costs, and accurately evaluate every step of the user journey, from pre-installation to post-installation and beyond. Adjust provides a single platform for mobile attribution, campaign automation, privacy and data protection, giving cryptocurrency app marketers the tools they need to grow their apps at any stage.

To learn more, download our new Fintech Deep Dive: Digital Currencies 2022 Playbook and find out how crypto apps fared in 2021, what is the user acquisition rate of crypto apps versus stock trading apps, and how crypto apps can maximize effectively attract and retain users with high LTV.

Would you like to receive Adjust updates?

Subscribe to our newsletter to be the first to receive mobile news: